BTC Price Prediction: Technical Strength and Institutional Momentum Signal Potential Breakout

#BTC

- Technical Strength: Bitcoin trading above 20-day moving average with Bollinger Band positioning suggesting upward potential

- Institutional Momentum: Major investments from Hyperscale, MicroStrategy, and traditional finance exploring blockchain integration

- Scarcity Dynamics: Bitcoin scarcity index rising for the first time in months, supporting long-term value proposition

BTC Price Prediction

Technical Analysis: Bitcoin Shows Bullish Momentum Above Key Moving Average

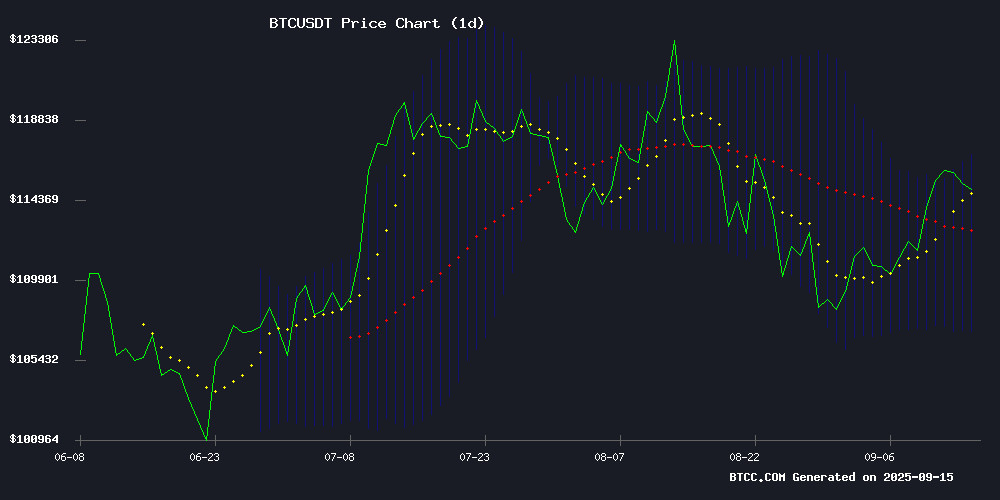

Bitcoin is currently trading at $114,593, comfortably above its 20-day moving average of $111,951. This positioning suggests underlying strength in the market. The MACD indicator shows negative values across all parameters (-2132.4939 signal line, 122.8528 MACD line, -2255.3468 histogram), indicating some near-term bearish momentum but potentially setting up for a reversal. The Bollinger Bands configuration, with price trading between the upper band at $116,831 and middle band at $111,951, suggests Bitcoin is in a relatively stable range with room for upward movement.

According to BTCC financial analyst Mia, 'The technical setup suggests bitcoin is consolidating above key support levels. Trading above the 20-day MA while approaching the upper Bollinger Band indicates bullish sentiment building in the market.'

Market Sentiment: Institutional Adoption and Scarcity Drive Positive Outlook

Recent developments paint a fundamentally strong picture for Bitcoin. Major institutional moves include Hyperscale's $100 million investment and MicroStrategy's additional $60.2 million purchase, bringing their total holdings to 638,985 BTC. The Bitcoin scarcity index has increased for the first time since June, while BlackRock's exploration of blockchain-based ETF tokenization signals growing traditional finance integration.

BTCC financial analyst Mia notes, 'The combination of institutional accumulation, scarcity dynamics, and traditional finance adoption creates a powerful bullish narrative. While Peter Schiff's bearish comments and liquidation risks present short-term concerns, the fundamental drivers appear strongly positive.'

Factors Influencing BTC's Price

BTC Price Eyes Upside as Bitcoin Scarcity Index Jumps for First Time Since June

Bitcoin's scarcity index on Binance has surged for the first time since June, signaling renewed buying pressure as the BTC price hovers near $114,855. The spike suggests demand now outstrips supply, potentially marking the start of an accumulation phase by whales and institutions.

A similar pattern in June preceded a rally toward $124,000. Michael Saylor's MicroStrategy further bolstered bullish sentiment with its latest $60.2 million BTC purchase, underscoring institutional confidence in the digital asset.

Hyperscale Invests $100M in Bitcoin, Expands Michigan AI Campus

Hyperscale Data, Inc. is pivoting toward AI and digital assets with a $100 million Bitcoin investment, funded by the sale of its Montana data center assets and equity proceeds. The firm will hold Bitcoin as a treasury reserve, emulating MicroStrategy's strategy, while expanding its Michigan AI campus.

The Michigan facility, powered by NVIDIA GPU servers, currently operates at 30 megawatts with plans to scale to 70 megawatts within 20 months. Long-term ambitions target 340 megawatts, pending regulatory approvals and funding. Hyperscale's subsidiary, Sentinum, brings years of Bitcoin mining expertise to the new strategy.

Weekly disclosures of crypto holdings aim to ensure transparency as the company solidifies its dual focus on AI infrastructure and Bitcoin adoption.

Bitcoin Faces $657M Long Liquidation Risk Amid Key Resistance Test

Bitcoin's price briefly touched $116,181 before retreating below $115,000, underscoring stiff resistance near the $116,500 level. Analyst Doctor Profit suggests this consolidation may precede a larger move, with a potential test of $125,000 looming.

The Federal Reserve's impending rate decision adds uncertainty, leaving traders questioning whether Bitcoin will break out or face another sharp decline. Retail traders who bought between $117,000 and $122,000 remain underwater, creating a pool of potential selling pressure.

Market makers appear to be quietly distributing holdings in the $115,000–$125,000 range, avoiding dramatic price movements that might trigger widespread panic. Recent liquidations totaled $45 million, predominantly from long positions.

A breach below $114,000 could force $657 million in long liquidations, while surpassing $116,000 may trigger $210 million in short squeezes. This narrow band represents a critical inflection point for Bitcoin's near-term trajectory.

MicroStrategy Bolsters Bitcoin Holdings with $60.2 Million Purchase

MicroStrategy (MSTR) disclosed in an SEC filing Monday its latest acquisition of 525 Bitcoin for $60.2 million, executed at an average price of $114,562 per coin. The purchase elevates the company's total Bitcoin treasury to 638,985 BTC, maintaining its position as the largest corporate holder of the cryptocurrency.

The announcement coincided with a modest pullback in Bitcoin's price during European trading hours, dipping from near $117,000 to approximately $115,000. Despite this short-term volatility, Bitcoin has outperformed MSTR shares year-to-date, posting a 23% gain compared to the company's 11% equity appreciation.

MicroStrategy's unwavering accumulation strategy continues to demonstrate institutional conviction in Bitcoin's long-term value proposition. The company's shares traded at $330 in pre-market activity, reflecting market sentiment toward its Bitcoin-centric corporate strategy.

Strategy's Billion-Dollar Bitcoin Bet Reshapes Crypto Markets

MicroStrategy has cemented its position as the corporate world's most aggressive Bitcoin accumulator, amassing 638,985 BTC worth $73.48 billion at current prices. The business intelligence firm's latest purchase of 525 BTC for $60.2 million continues its uncompromising strategy initiated in 2020.

The company's average acquisition cost of $73,913 per BTC now yields 25.9% annualized returns, with unrealized gains exceeding $26 billion. This relentless accumulation through both bear and bull markets has transformed MicroStrategy into a bellwether for institutional crypto adoption.

Michael Saylor's debt-funded buying spree has inspired hundreds of corporations to establish crypto treasury reserves. The firm's public filings and transparent accounting have created a blueprint for balance sheet cryptocurrency exposure that continues to influence market dynamics.

Peter Schiff Predicts Bitcoin Topping Out as Gold and Silver Rally

Veteran investor and Bitcoin critic Peter Schiff has reiterated his stance that Bitcoin may be nearing its peak, contrasting its performance with the surging prices of gold and silver. Schiff argues that the Federal Reserve's potential rate cuts amid rising inflation could fuel demand for precious metals, with mining stocks already leading the charge.

"The Fed is about to make a major policy mistake by cutting interest rates into rising inflation," Schiff stated on X. "Gold and silver have broken out, with the rally finally confirmed by mining stocks leading the way. Yet instead of breaking out, Bitcoin is topping out. Time to change horses, HODLers."

Schiff highlighted Bitcoin's underperformance, noting it remains 15% below its 2021 peak when priced in gold. His skepticism aligns with his long-standing view of Bitcoin as a speculative asset compared to tangible stores of value like gold.

Texas Teachers Retirement Fund Gains Bitcoin Exposure via MSTR Stock

The $200 billion Texas Teachers Retirement Fund has allocated $25 million to Bitcoin through an investment in MicroStrategy (MSTR) shares. The move reflects growing institutional acceptance of cryptocurrency as a strategic asset class.

MicroStrategy's stock has outperformed major tech equities, buoyed by its substantial Bitcoin holdings. The company's aggressive accumulation strategy under Michael Saylor continues to attract institutional capital seeking crypto exposure without direct ownership.

Texas regulators have relaxed investment restrictions, enabling pension funds to explore digital assets. This development signals broader recognition of Bitcoin's role in institutional portfolios amid evolving regulatory frameworks.

Cloud Mining Emerges as a Viable Alternative to Traditional Bitcoin Mining

The cryptocurrency mining landscape is undergoing a significant transformation, with cloud mining emerging as a more accessible and cost-effective alternative to traditional methods. While Bitcoin mining remains the most recognizable form of cryptocurrency mining, its reliance on specialized ASIC equipment, high power consumption, and substantial cooling requirements has made it increasingly unprofitable for individual miners.

Cloud mining platforms like SJMine are disrupting the industry by eliminating the need for expensive hardware and technical expertise. These platforms allow users to rent mining power remotely, enabling them to earn daily returns without the logistical challenges of managing physical equipment. The shift toward cloud-based solutions reflects a broader trend of democratizing access to cryptocurrency mining.

Bitcoin's dominance in the mining sector persists, but the economic barriers to entry have prompted many to explore alternatives. Cloud mining not only reduces upfront costs but also mitigates ongoing expenses such as electricity and maintenance. As the crypto ecosystem evolves, cloud mining is poised to become a mainstream option for both retail and institutional investors seeking exposure to digital assets.

Strategy Expands Bitcoin Holdings to 638,985 BTC as Saylor Endorses Digital Asset

Strategy, formerly MicroStrategy, has acquired an additional 525 BTC for $60.2 million, marking its seventh consecutive week of Bitcoin purchases. The company now holds 638,985 BTC worth approximately $73.4 billion, acquired at an average price of $73,913 per Bitcoin. Executive Chairman Michael Saylor attributes the firm's long-term success to its Bitcoin strategy, stating the cryptocurrency "deserves credit."

The latest purchase was executed between September 8-14 at an average price of $114,562 per BTC, funded through preferred stock sales. Despite market volatility, Strategy maintains its weekly accumulation pattern, demonstrating unwavering commitment to Bitcoin as a core treasury asset.

Bitcoin's Resurgence Sparks Speculation of New All-Time High

Bitcoin has reclaimed momentum, with its total market value exceeding $116,000, signaling a potential shift in investor sentiment. After lagging behind traditional assets like gold and the S&P 500, BTC is now outperforming, driven by institutional adoption, easing macroeconomic pressures, and renewed retail interest. The question now is whether this bullish momentum can propel Bitcoin to a new record high.

Market dynamics remain cautious, however. Distribution pressure—measured by holders selling their coins—has softened but not reversed into aggressive accumulation. Glassnode data shows no investor cohort has reached the 0.8 threshold, a level that would indicate strong buying interest. Most holders remain neutral or slightly bearish, keeping Bitcoin in a neutral-to-distribution phase with lingering selling pressure.

BlackRock Explores Tokenization of Traditional ETFs on Blockchain

BlackRock, the world's largest asset manager, is investigating the transformation of conventional exchange-traded funds into blockchain-based tokens. This initiative follows the regulatory success of Bitcoin ETFs, which has paved the way for innovative financial products. The firm aims to digitize access to real-world assets like equities, contingent on overcoming regulatory challenges.

Tokenization could revolutionize ETF efficiency, transparency, and cost structure. Blockchain's inherent features—such as automated settlement and fractional ownership—may streamline trading and custody. BlackRock's move, if realized, could catalyze widespread adoption across the financial industry, though compliance hurdles and legal classifications remain unresolved.

Is BTC a good investment?

Based on current technical and fundamental analysis, Bitcoin presents a compelling investment case. The price trading above key moving averages combined with strong institutional adoption suggests positive momentum. However, investors should consider both opportunities and risks.

| Factor | Assessment | Impact |

|---|---|---|

| Price vs 20-day MA | Above average ($114,593 vs $111,951) | Bullish |

| Institutional Investment | Strong (Hyperscale $100M, MicroStrategy $60.2M) | Very Bullish |

| Scarcity Index | Increasing (first rise since June) | Bullish |

| MACD Indicators | Negative but potentially reversing | Neutral to Bearish |

| Liquidation Risk | $657M long positions at risk | Bearish Short-term |

As BTCC financial analyst Mia emphasizes, 'While technical indicators show some mixed signals, the fundamental institutional adoption and scarcity dynamics create a strong long-term investment thesis. Investors should position accordingly with proper risk management.'